FEDERAL TAX CREDIT

This is a great time to invest in solar panels due to the available federal tax credit. Not only are you not paying for electricity and increasing the value of your home, you can pay less in taxes? The credit is only for a limited time, so here we break it down and answer the important questions.

Which federal tax credit is available?

The Investment Tax Credit (ITC) - The ITC allows you to deduct a portion of the cost of installing solar panels and solar water heating systems from your federal income taxes. This applies to residential properties (under Section 25D) and commercial properties (under Section 48). The credit was initially put in place in 2005 and was set to expire in 2007. This was extended through 2016 and again through 2023, due to the high demand of solar energy and the country's overall transition to renewable energy sources. With tax law continually changing, it's a good idea to take advantage of the credit while it's still available.

What is a tax credit?

A tax credit is a dollar-for-dollar reduction in the taxes you owe. For example, if at the end of the year you owe $6,000 in federal income taxes, you can then reduce those taxes by a portion of the cost of your solar panel system. It is a non-refundable credit, meaning you can only deduct up to the amount you owe. You will not receive a refund for your excess energy credit. Instead, you can roll over any remaining credit to future years so you won't lose any credit. It is important to note, If you are a tax-exempt entity (ex. Nonprofit), you cannot claim the tax credit.

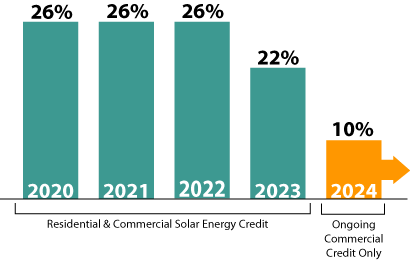

How much is the tax credit?

Currently, 26% of the cost of your system. The credit phases out through 2023.

What costs are included in determining my credit?

Solar panels, labor, wiring, piping and structures that are necessary for the installation of your solar panels; basically any cost associated with the project.

Energy storage is included, as long as it's powered by solar energy AND you must own the system (no leasing). For commercial energy storage, it must be charged by renewable energy at least 75% of the time. Then, for commercial storage, the amount of the credit is based on the amount of time the battery is charged using solar. If the battery is charged 80% of the time with solar, you will qualify for 80% of the credit.

Structures and roofs are included if necessary for the installation of the solar panels. Per the IRS, "No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed."

Solar water heaters are included if at least half of the energy generated comes from the solar panels. The water must be used in your home and the water heater must be certified by the Solar Rating and Certification Corporation (SRCC).

What if I lease my solar panels?

Not eligible - In order to take the tax credit you must purchase/finance the solar panels rather than lease them.

Can I take the credit for solar panels on a second home?

Yes - However, the credit is reduced based on the amount of time you reside in the second home. If you live in the home half of the year, you can take 50% of the credit.

Rental properties also qualify for the credit. Solar panels installed on residential rental properties qualify under ITC Section 48 for business property. Additionally, the solar panels are depreciable over 5 years, while energy storage alone can be depreciated over 7 years. If the tax credit is taken, the depreciable basis of the energy system must be reduced by half of the ITC (ie. 15% in 2018-2019).

What types of homes are eligible?

A home includes a house, houseboat, mobile home, cooperative apartment, condominium, or a manufactured home.

Does the installation need to be completed by the end of the year to qualify for the credit?

Construction must begin by the end of the tax year to qualify for the current year's credit.

The definition of the 'beginning of construction' is either (1) significant physical work being performed by the taxpayer or contractor (onsite or offsite), or (2) 5% of the project is paid for by the end of the year and continuous efforts are made towards completing the project.

How do I claim the tax credit?

IRS Form 5695 for residential; Form 3468 for commercial, which flows to Form 3800

Have additional questions? Send us an e-mail and we would be happy to help! We are not tax professionals so of course, always consult a tax professional prior to making any tax-driven decisions on your solar project.